Menu

Menu

“Quality Assurance

Framework”- Streamlined

Tactical Issue

The Global Consumer Risk Quality Assurance Framework (QAF) provides a common end-to-end risk control framework

which ensures that high risk elements across each phase of credit cycle are executed. The Global Credit Risk – Quality

Assurance area is using a traditional in-house development based on traditional tools like MS SharePoint, MS InfoPath,

MS Access and MS Excel to capture the results of control execution.

Business Embargo: The key business issues

“Nice” spotlight: Opportunities mined from challenges

NSS’ BI team of experts designed a solution considering cross-organizational integration of information for decisionsupport purposes such as sales reporting, key performance indicators (KPIs), and trends analysis. Personalized and

customized customer relationship management (CRM) reporting helped the business users to understand customer

needs, strengthen customer relationships, track trends, identify profitable areas, and prevent fraud.

Solution strategy innovated: The NICE pursuit

Our Role

- Architecture design, Installation, and technology solution

- Requirement un-earthed, data analysis, and data modeling

- BI application designing and development

- Knowledge transfer

Our Focus

1. MicroStrategy Deployment

- Granular insight to tangible action risk analysis dashboard for multilevel and multidimensional analysis in

collaboration with business. Summary analysis for monthly and quarterly data at regional and country. - Dramatic reduction in turnaround time in managing the varied variables involved in financial transactions

through powerful and compelling visualizations. - Smooth promulgation of the PDF’s and documents across levels for quick and offline analysis and

comparative study. - The precision to transforming the extant reporting process led to a cost effective and time-saving solution.

2. Standardized model

- Created and deployed single screen consolidation to display all aspects of global risk factors on the bank

portal for users - Visualized key metrics for business users with access to secured and critical data based on aggregated

information from disparate data sources. - Our team of DWH and BI experts designed a standardized model to create a unitary reporting structure with

clear allocation of elements to categories and made it dynamic to maximum extent, thus decreasing the

maintenance effort related to these structures. Chunked complex business process into automated workflow

thereby reducing the complexity for the user to be able to make swift decisions

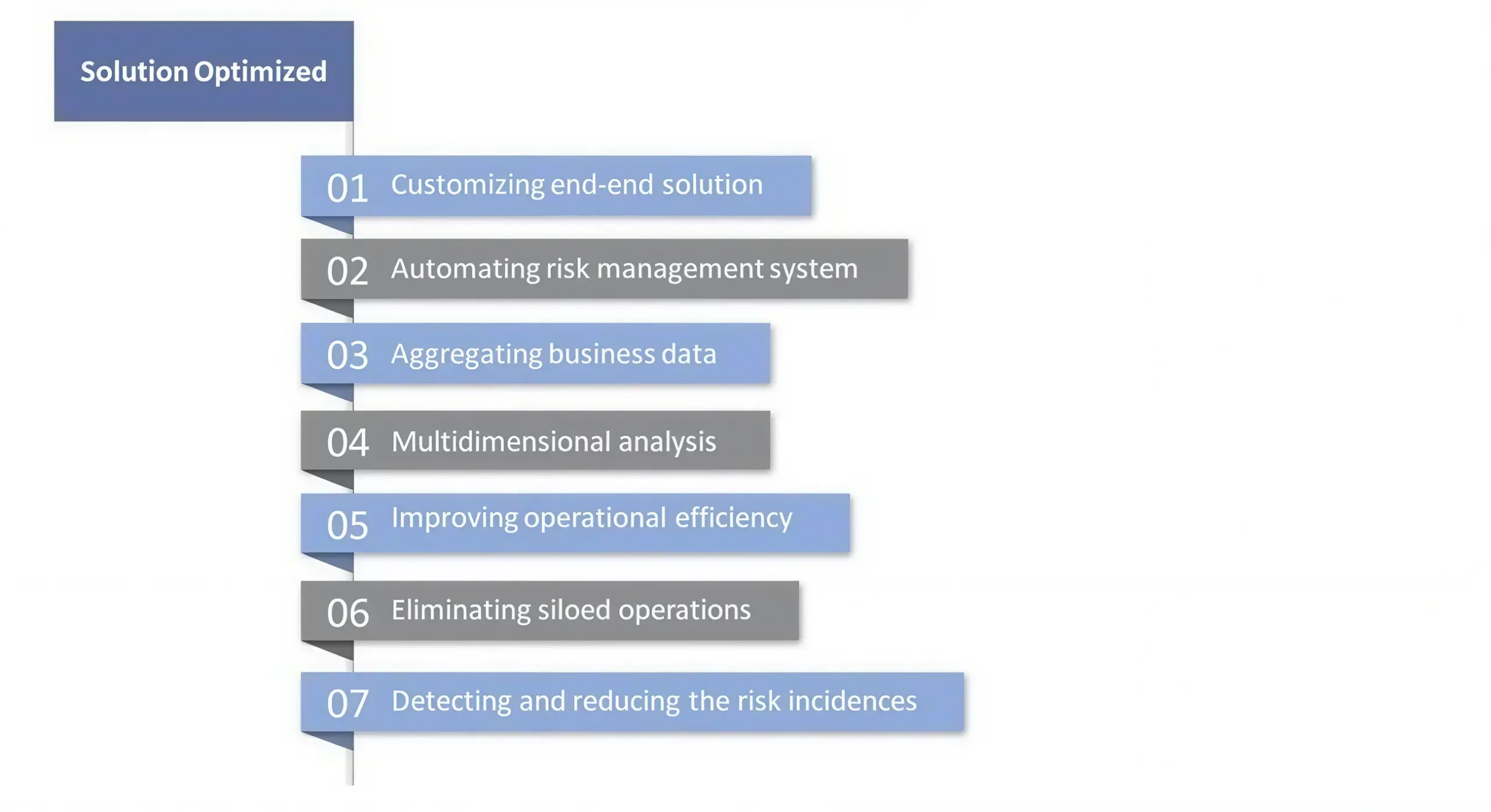

Intelligent Solutions Proffered

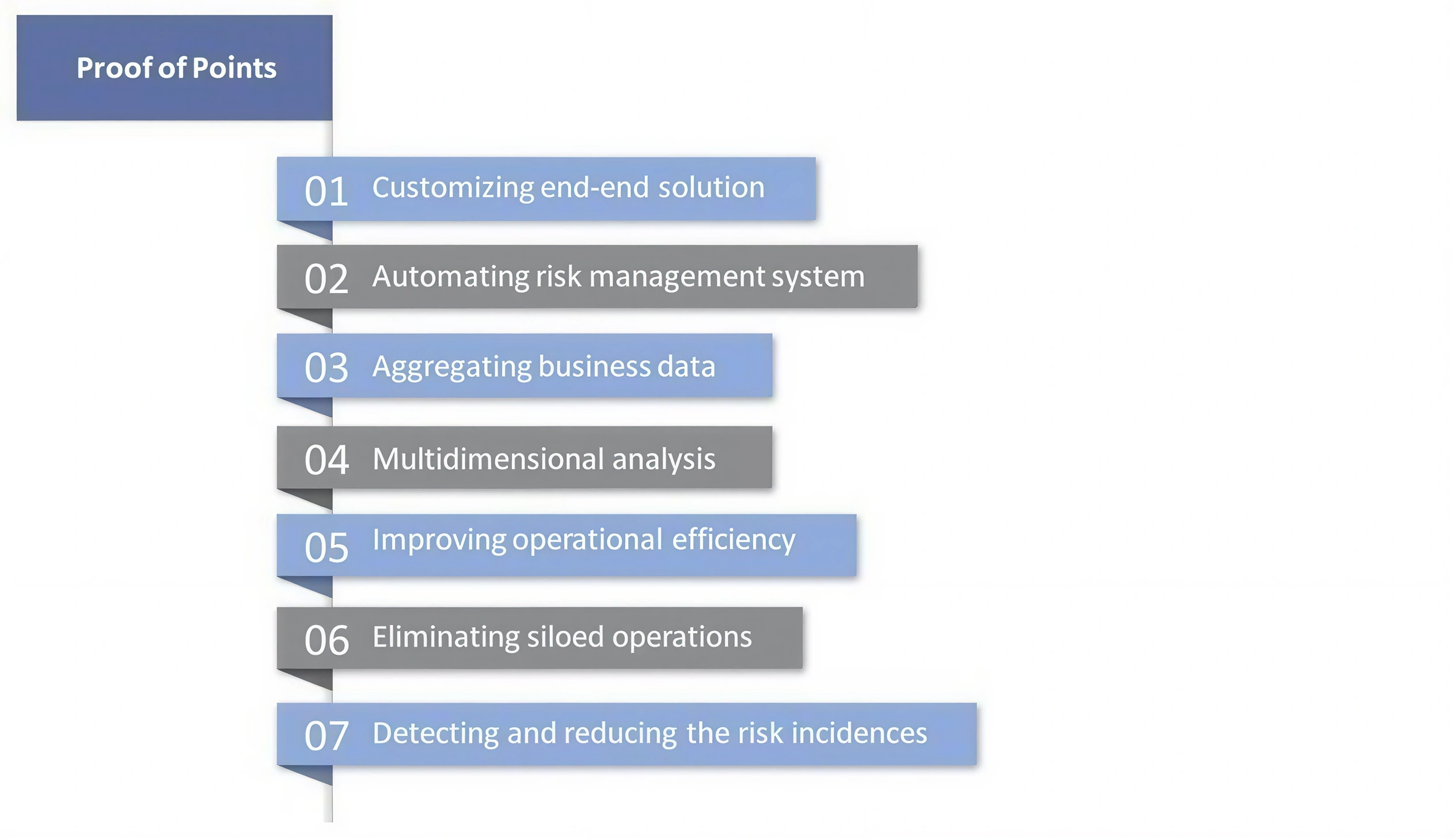

Proof of

Points

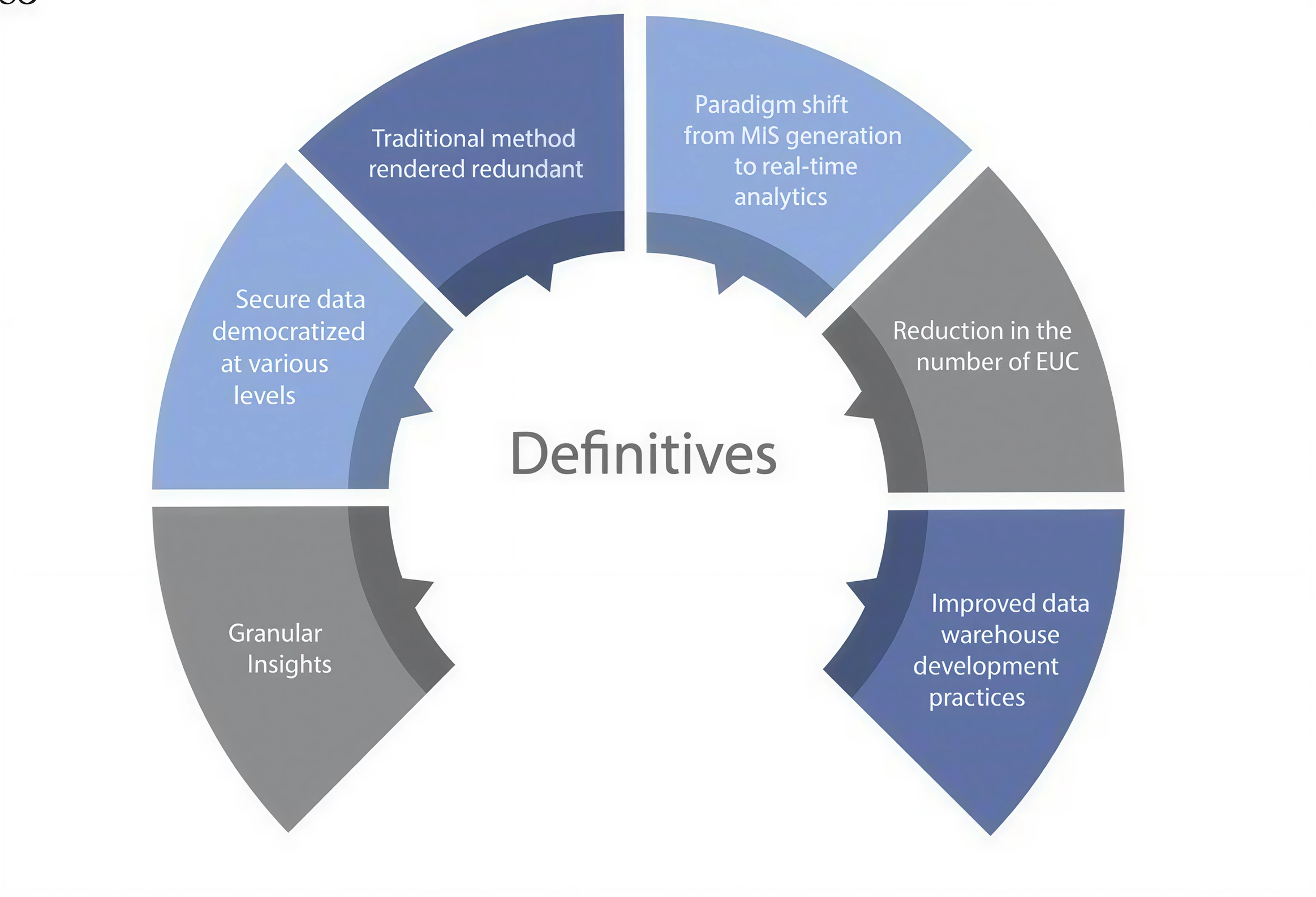

Definitives

The “Nice” USP

Our customized end-to-end BI solutions are employed by leading financial organizations and firms to improve speed

and agility, for risk aversion, enable calculated decision-making, and drive down costs and additionally empower our

customers to explore many more opportunities for benefits by harnessing their investment in any BI platform. We

understand and foresee that our BI solutions will be an extension to their current reporting capabilities. Our USP lies

in our personalized approach to provide solutions to client’s technical, function and non-functional needs.

To learn more about our innovative functional and technical workshops, prototype designing activities, customized

onsite and online trainings, educative handholding sessions and end user specific interactive videos and courses,

please visit us www.nicesoftwaresolutions.com

or email us at info@nicesoftwaresolutions.com.

Recent Case Study