Menu

Menu

“Implementation of business

intelligence solutions for risk

management” – Technology

Risk Management

Managing technology risk: Business Priority

For financial organizations the major impediment is to gain a coherent view of the financial position and risk aversion. The increased transactions led to the spiraling growth in the volume of data. As the bank business ramifies it becomes necessary to identify, manage, and monitor the business technology risks. One of the most significant concerns raised at the firm was of data quality and assurance. To achieve this financial institutions need to ensure they have an enterprise view of risk. Data accuracy and security is the buzz word. The dashboards and the underlying data will also be available to Independent Risk Managers for independent challenge and other risk management activities. In particular, this data will be leveraged to include activities related to the identification of Technology Key Risk Indicators. Technology risk is the major factor contributing to the internal risk.

Intelligent Stratagem: The “Nice”approach

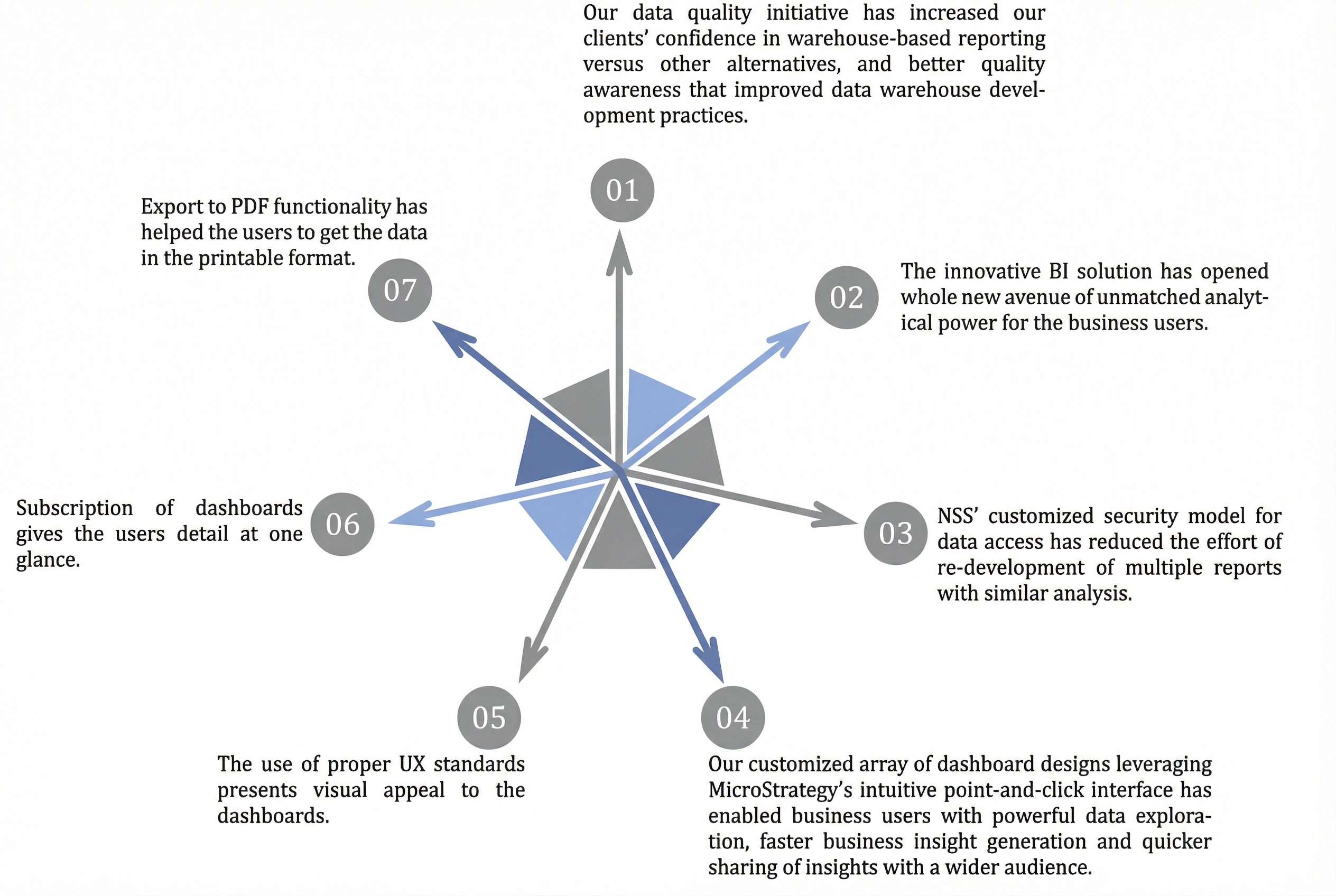

Our team of BI experts evaluated the implementation of BI platform and visualization techniques for risk management. The result of extensive research, planning, and design delivered a solution to load data from legacy records, store the data with the ability to recall the data anytime and helped the managers to understand the internal risk areas and act on it in timely manner. The resulting system demonstrated the capability of business intelligence to meet the needs of the financial organization. Dashboards like: Outages, Continuity of Business, Desktop Vulnerability, Issues (ICAPS), and Application Security Management helped the managers to understand the trend and severity of the risks impacting the applications.

The “Nice”Approach

NSS’ DWBI team performed data discovery to decipher the business requirement, the KPI’s, the valued metrics, and

the scope along with the underlying data landscape to proffer a comprehensive solution to convert the data into actionable insights and also address a plethora of challenges met by Finance team producing the Daily Balance Sheet.

Our Solution

The opportunities were mined from the challenges and were examined to streamline and improve the different stages of risk aggregation and displaying the data in an accessible and meaningful manner to business users. The steps are as follows:

1. MicroStrategy Deployment

a. Insight to Action:

Value Proposition

With access to critical data, managers need to be able to visualize key metrics and risked applications based on the aggregated information from different data sources and achieve deeper insights into business performance. One of the major challenge identified was grouping and hierarchies that belonged to different data sources.

Our team of BI experts designed a standardized model to create a unitary reporting structure with clear allocation of elements to categories and made it dynamic to maximum extent, thus decreasing the maintenance effort related to these structures. As a next step, all the 18 prompted dashboards were integrated in one portal which provided easy access to the users. The reports and documents covered top to bottom demographic details across products, segments, channels, and to slide and dice the information on business user’s demand.

Definitives of Business Benefits

The “Nice” USP

Our bespoke end-to-end BI solutions are employed by leading financial organizations and firms to improve speed and agility, for risk aversion, enable calculated decision-making, and drive down costs and additionally empower our customers to explore many more opportunities for benefits by harnessing their investment in any BI platform. We understand and foresee that our BI solutions will be an extension to their current reporting capabilities. Our USP lies in our personalized approach to provide solutions to client’s technical, function and non-functional needs.

To learn more about our innovative functional and technical workshops, prototype designing activities, customized onsite and online trainings, educative handholding sessions and end user specific interactive videos and courses, please visit us www.nicesoftwaresolutions.com or email us at info@nicesoftwaresolutions.com.

Recent Case Study

Team Analysis View as Microsoft Teams Hierarchy

06 Jan, 2026

Power Bi Report Embedding

06 Jan, 2026

MSTR To Power Bi Migration

06 Jan, 2026

Embedding Power Bi Report

06 Jan, 2026