Menu

Menu

Business Intelligence

Solution for astute

migration – MS Excel to

MSTR

Problem Statement

Our client, a premier bank with a substantial presence in the Gulf territory was maintaining “Daily Balance Sheet”

manually in MS Excel, with the ever-growing number of branch network the volume of transactions became

enormous. The month end operations, reconciliation, and reprocessing exhaustive excels was time-consuming and

prone to error that called for intensive manual correction. The daily reporting was an ever-lasting struggle.

Critical Issues

- Data silos

- Time lag in data consolidation

- Aggregation of data

- Crummy and redundant data

- Unavailability of homogenous data for quick analysis

- Lack of data granularity required for developing analytics

- Data not democratized

- Error-ridden reporting

- Absence of real-time insights

The “Nice”Approach

NSS’ DWBI team performed data discovery to decipher the business requirement, the KPI’s, the valued metrics, and

the scope along with the underlying data landscape to proffer a comprehensive solution to convert the data into actionable insights and also address a plethora of challenges met by Finance team producing the Daily Balance Sheet.

Solution Augmented

After the data discovery was run, the intelligence team created the blueprint and foundation of migrating manual

excel reporting to automated delivery of data to business users for analysis.

1. Enterprise Data Warehouse:

01

Thorough study of daily General Ledger balance data extraction schedule helped us to automate data loading into staging tables.

02

Using Stored Procedures, NICE Team took care of complex business logic and specific data transformation requirement, processing manual adjustment, and finally populating Warehouse tables for reporting.

03

Identified the necessary elements required in database structure to fulfill the reporting requirements in MicroStrategy.

2. MicroStrategy Deployment

Considering dependency on IT and manual efforts and ETL cost, MicroStrategy itself would conduct ETL via

Stored Procedure which is run through pre-statement, a feature in VLDB properties of report to load data

finally into reporting tables and publish Daily Data Load status to stakeholders.

01

System Manager was used to check health of data before running reports. Email alerts were automated to ETL team & Finance stakeholders to check for gaps in data in trial reports.

02

Finally, Daily Consolidated Balance Sheet report was run and delivered through email to Finance team.

03

Business users are even empowered to custom run script and reprocess data after posting adjustment from MicroStrategy end by FFSQL report thus eliminating IT intervention.

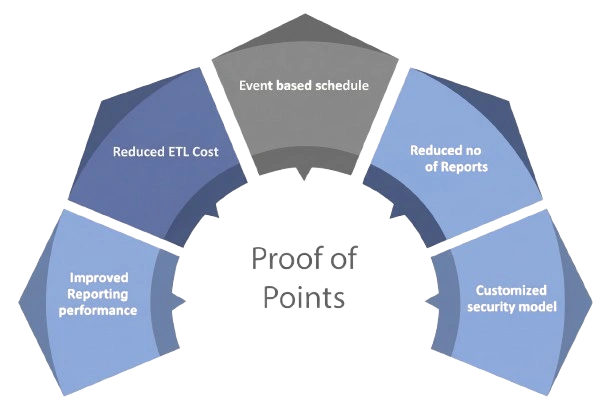

Proof of Points

Business Value

The traditional reporting system employed several days to publish final Balance sheet reports. Now, it takes few hours

to complete month end BAU. Since MicroStrategy enabled business users directly run Data refresh jobs, it reduced

ETL maintenance cost. The Staging tables being loaded at different time for different region, MicroStrategy’s Event

based schedule was instrumental in syncing of multiple sources into DWH. Group wide reporting now operated on

much reduced timescale. The creation of common metadata for the dashboards helped to reduce redundant datasets

& schema objects. Our customized security model for data access reduced the effort of re-development of multiple

reports with similar analysis taking financial consolidation to the next level. The banking giant did acknowledge the

transformative role that our innovative solutions played in altering their reporting scene because now they spend

more time on analysis than on creating manual reports.

The “Nice” USP

Our bespoke end-to-end BI solutions are employed by leading financial organizations and firms to improve speed and

agility, for risk aversion, enable calculated decision-making, and drive down costs and additionally empower our

customers to explore many more opportunities for benefits by harnessing their investment in any BI platform. We

understand and foresee that our BI solutions will be an extension to their current reporting capabilities. Our USP lies

in our personalized approach to provide solutions to client’s technical, function and non-functional needs.

To learn more about our innovative functional and technical workshops, prototype designing activities, customized

onsite and online trainings, educative handholding sessions and end user specific interactive videos and courses,

please visit us www.nicesoftwaresolutions.com or email us at info@nicesoftwaresolutions.com.

Recent Case Study

Team Analysis View as Microsoft Teams Hierarchy

06 Jan, 2026

Power Bi Report Embedding

06 Jan, 2026

MSTR To Power Bi Migration

06 Jan, 2026

Embedding Power Bi Report

06 Jan, 2026